Humans are so clever that they easily secure their insecurity. We are afraid of loss. Be it our favorite bike, our expensive phone, our newly bought car, or our life. But we also want to secure our these insecurities and the solution for all of them is Insurance. Here we are going to discuss about the use of GIS in Insurance Industry. The insurance involves the insured or people assuming a guaranteed and known relatively small loss in the form of payment to their insurer or insurance company in exchange for the insurer’s promise to compensate the insured people in the event of a covered loss. In this modern society, you can get insurance of almost anything you want, it can be a phone or an island.Using GIS in Insurance

Industry is one of the highly profitable industries initiative in today’s time.

GIS In Insurance Industry

GIS can provides Insurance companies every location-based insight they need and It can also be used as Risk Manager as It uses smart maps, data analysis and all of the features for controlling risks and managing business strategies of Insurance companies.

Insurance companies also uses tools like Insurance Management GIS Web/App Development – Cost, Time – Map Tool. Visit the link for more information about the tool. lets get back to ask what is the major pillar of the Insurance company business and i think the answer is Location Information.

Location Information, like knowing about where your assets are located

and their closeness to hazards, is essential when developing risk

profiles for the Insurance Industries. GIS dispense tools that allow users to combine location-based data, such as road entry, and traffic

flow patterns, to make more informed decisions. This kinds of

information helps insurers to fulfill the requirements of their customers.

Benefits of GIS in Insurance Industry

GIS in Insurance Industry has the range of functions which allows the use of policyholders data and spatial analysis to effectively serve customers and monitor fraudulent activities by embracing location-based intelligence. Over the years, Insurance companies are getting really good at calculating risk because they hold a lot of risk.

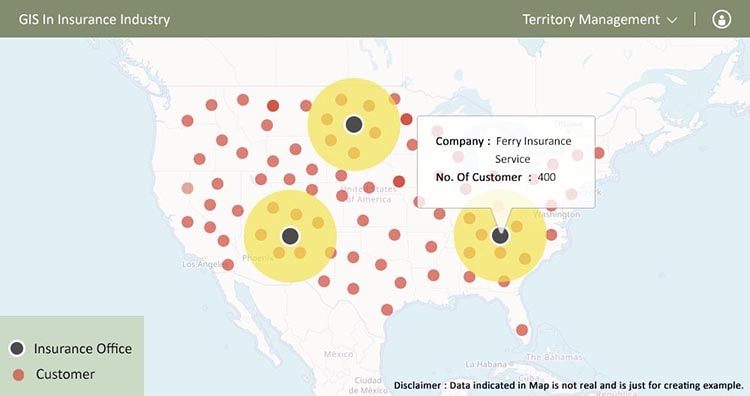

GIS helps Insurance companies offer such low premiums for the high value insurances because with the help of GIS one Insurance company can divide a state into thousands of territory, which also divides the premium amount one has to pay.

GIS provides Geo-fencing, which is a virtual barrier in the real world. Geo-fencing is used in ca-rental or car-share to understand the limits of speed or drinking .

Uses of GIS in Insurance Industry

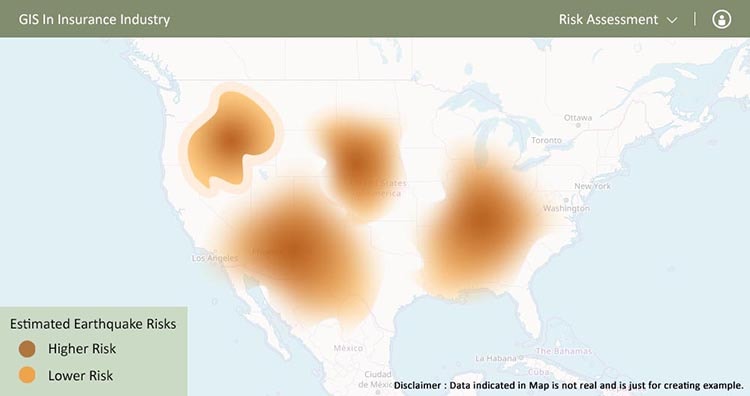

- Insurance Risk Assessment : GIS understands the disaster proximity to improve the Insurance risk assessment. GIS helps location analytics provides an easy way for insurance companies to discover unknown problems, model situations, and implement the best solutions to minimize risk. Insurance risk assessment uses GIS to predict the risk. the level of risk decides the premium value. Higher risk extends higher premiums and lower premiums are for areas with less risk.

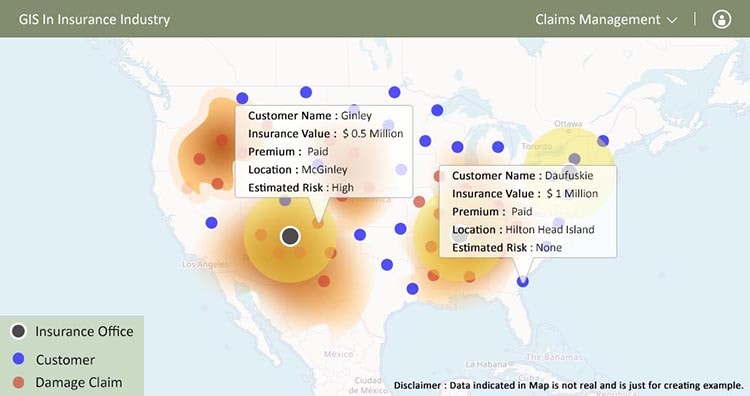

- Claims Management : Insurance companies get the understanding about the Risk location and customers location from GIS. which helps in processing claims with respect to compensation, restoration, and repayment in response to the damage of the customers. This is the proactive approach to responding to customers with their claims rapidly and in an organized-way.

- Territory Management: GIS helps Insurance companies in their territory management and the analysis shows how geography interacts with hazards and assets to help companies limit risk. GIS helps in implanting and deploying the networks necessary to operate efficiently in your territory.

- Comparing Business Measures : You can easily map business measures and compare them with the help of GIS In Insurance Industry. It can validate various locations and visualize loss patterns on an interactive and beautiful maps.

The insurance industry expects to see more growth in Geo-spatial information in insurance as major players are getting involved in the technology. And this is why they have major needs of Insurance management tools. Do let us know how this Article is helpful for you, by commenting below in the comment box.